Summer of 2024: Sizzling temperature, heat wave to hit food prices, water, polls too

Summer and monsoon remain critical in India, already combating food-price led inflation. Rice and wheat, the two main staples, are staring at an uncertainty as IMD's forecast isn't encouraging

The cycle of higher number of days of heat waves poses a significant threat to the economy, especially farm income, food price-led inflation, and public health conditions.

Image: Getty Images

The cycle of higher number of days of heat waves poses a significant threat to the economy, especially farm income, food price-led inflation, and public health conditions.

Image: Getty Images

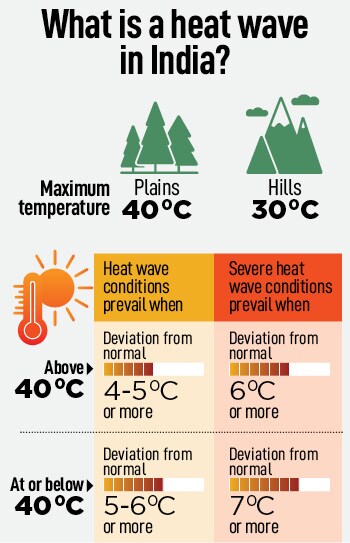

An average of two people lost their lives daily in India due to heat waves in April, May and June last year. A total 252 deaths due to heat-related issues were reported by June 2023, a whopping jump from 33 deaths in the same period of 2022. In fact, 2023 was one of the hottest years in 122 years with El Niño conditions making it worse. Will 2024 continue to burn in high heat despite El Niño ebbing?

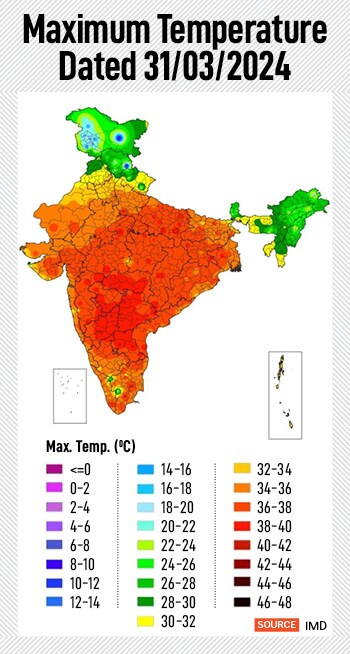

The answer seems to be yes. The Indian Meteorological Department (IMD) has warned of a sweltering summer with more than the usual number of heat wave days in this session. During April 2024, above normal heat wave days are likely over many parts of the southern peninsula, adjoining northwest central India, some parts of east India and plains of northwest India, IMD says.

The central and western peninsular parts are expected to face the worst impact of the extreme heat during April-June. IMD forecasts Gujarat, central Maharashtra, north Karnataka followed by Rajasthan, Madhya Pradesh, north Chhattisgarh, Odisha and Andhra Pradesh as most heat wave-prone areas.

The cycle of higher number of days of heat waves poses a significant threat to the economy, especially farm income, food price-led inflation, and public health conditions. Prolonged periods of extreme heat are required to be dealt with policy changes as climate change aggravates impacts of other coexisting crises in an economy that is still recovering.

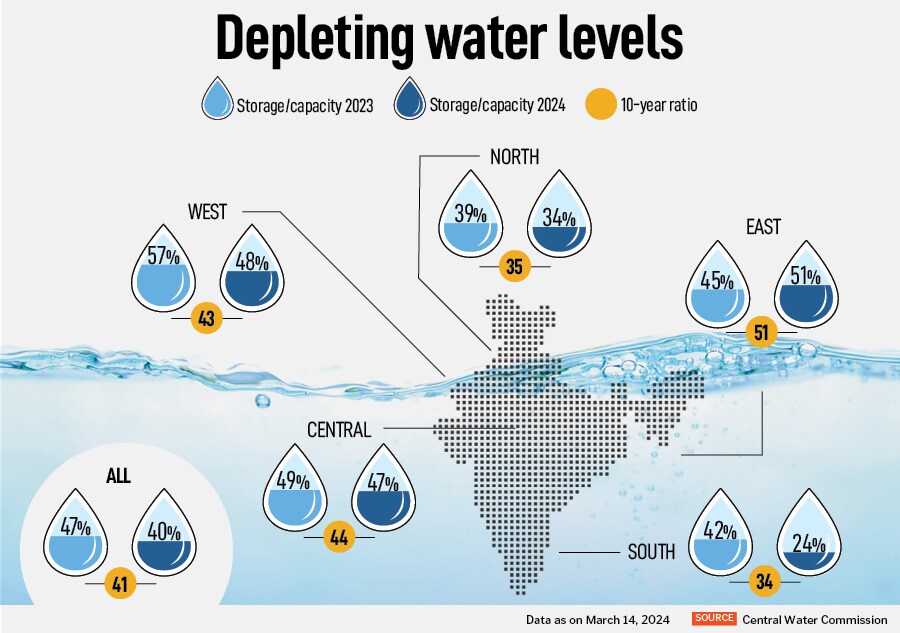

“The concerns are palpable,” says Madan Sabnavis, chief economist, Bank of Baroda. He adds the warning on summer is expected given that the reservoir levels are down considerably. The level is at 36 percent of capacity, which is lower than that of the same time last year, when it was 43 percent.

Rains are important when it comes to increasing the water levels in the reservoirs in the country. As monsoons are normally received in the June-September period, with limited states being subjected to the North East monsoon, which has shorter tenure between October and December, it is critical that the water that accumulates in the reservoirs are at healthy levels till the next season. This water is used for various purposes, such as drinking for people as well as cattle, fodder, cultivation etc.

Rains are important when it comes to increasing the water levels in the reservoirs in the country. As monsoons are normally received in the June-September period, with limited states being subjected to the North East monsoon, which has shorter tenure between October and December, it is critical that the water that accumulates in the reservoirs are at healthy levels till the next season. This water is used for various purposes, such as drinking for people as well as cattle, fodder, cultivation etc.  If La Niña indeed develops after June, then this should be welcome news for Asia, as it typically brings more rainfall and boosts agricultural production, especially for rain-dependent crops like cereals (including rice), says Sonal Varma, chief economist, Nomura.

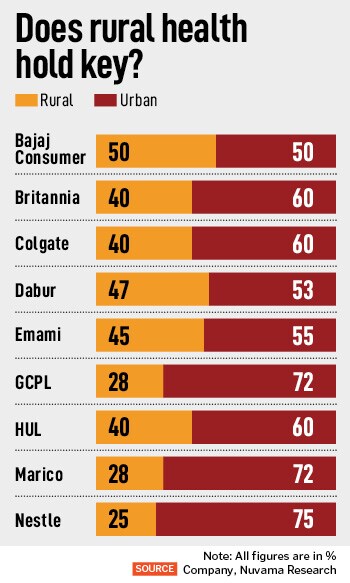

If La Niña indeed develops after June, then this should be welcome news for Asia, as it typically brings more rainfall and boosts agricultural production, especially for rain-dependent crops like cereals (including rice), says Sonal Varma, chief economist, Nomura. Kantar predicts a sluggish start for the FMCG sector in 2024, with potential improvement in the second half of 2024. “El Nino's impact on crop yields and production may affect the first half of CY24. Price cuts have led to a dip in value growth, hurting sales growth in categories such as hand wash, body wash, and cooking oils,” Kantar says. It anticipates a surge in demand for summer essentials such as beverages, laundry items, and ice creams.

Kantar predicts a sluggish start for the FMCG sector in 2024, with potential improvement in the second half of 2024. “El Nino's impact on crop yields and production may affect the first half of CY24. Price cuts have led to a dip in value growth, hurting sales growth in categories such as hand wash, body wash, and cooking oils,” Kantar says. It anticipates a surge in demand for summer essentials such as beverages, laundry items, and ice creams.